International capital market

International capital market Association (ICMA) is a self-regulatory organization and trade association for participants in the capital markets. It represents financial institutions active in the International economics capital market worldwide, with over 600 members located in 66 jurisdictions drawn from both the sell and buy-side of the market. ICMA aims to promote high standards of market practice, appropriate regulation, and trade. It has been at the forefront of the financial industry’s contribution to the development of sustainable finance and in the dialogue with the regulatory and policy community. Additionally, ICMA Education has been setting the standard of training excellence in the capital markets for almost five decades with courses covering everything from market fundamentals to the latest developments

Main Actors in the International capital market

The main players in the international capital market include:

- Governments: Governments can participate in the international capital market by issuing bonds to finance infrastructure projects or other financial needs.

- Companies: Companies can access the international capital market by issuing shares or bonds to finance their operations, expansion projects or mergers and acquisitions.

- Investors and Savers: Investors and savers are key actors, as they provide the funds that are channeled through the international capital market to governments and companies that need financing.

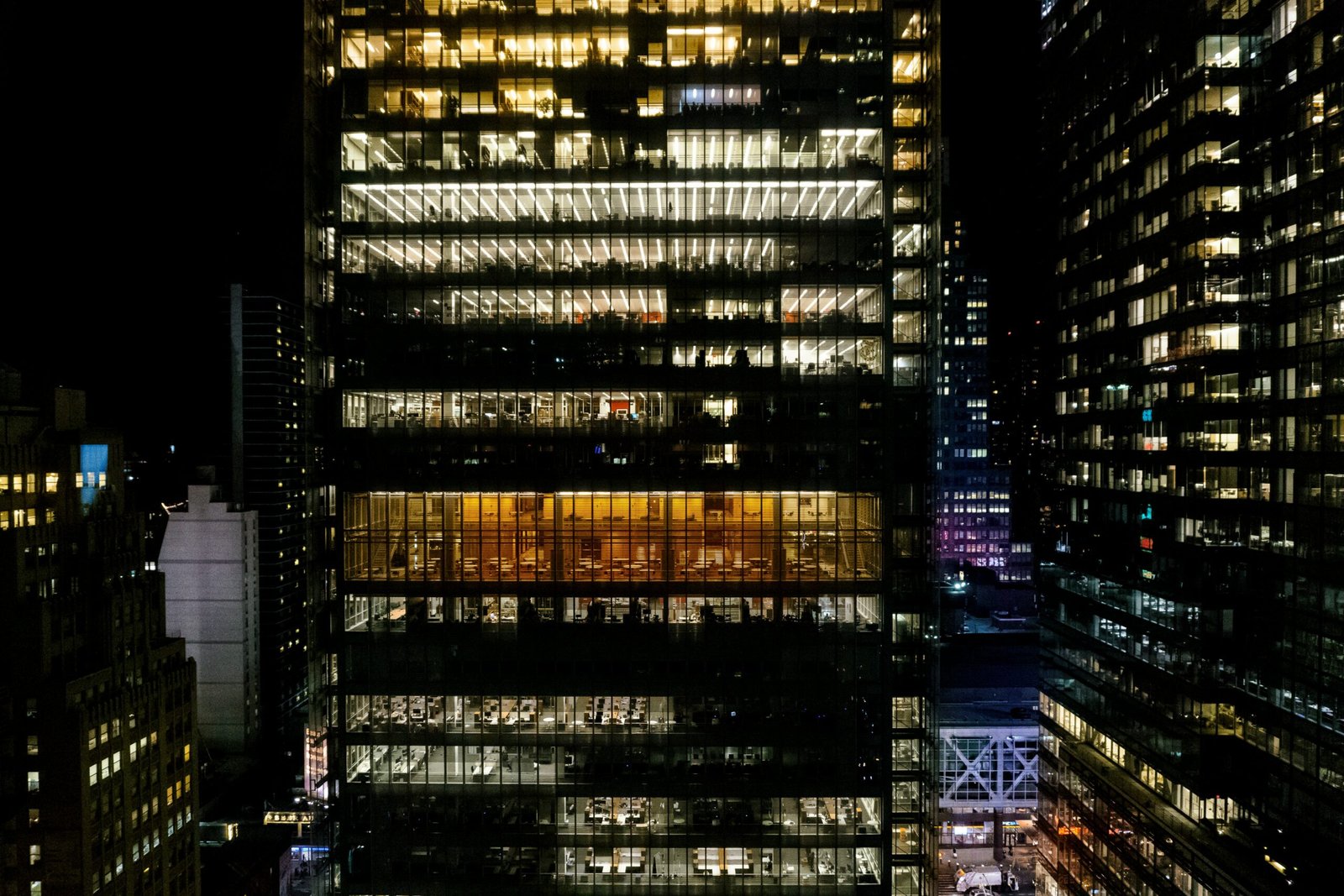

- Banks and Financial Institutions: International banks, investment banks, securities firms and financial institutions play a crucial role in facilitating the transfer of funds and the issuance of securities in the international capital market.

In summary, the main actors in the international capital market are governments, companies, investors and savers, as well as banks and financial institutions, which participate in the issuance, purchase, sale and facilitation of the transfer of funds at the international level. global

Types of International Financial International capital market

There are different types of international financial markets, some of which are mentioned below:

- Monetary Market: It is the market where short-term financial instruments are traded, such as Treasury bonds, corporate promissory notes and other short-term debt instruments.

- Capital Market: It is the market where long-term financial instruments, such as stocks and long-term bonds, are traded.

- Stock Market: It is the market where shares of public companies are traded.

- Derivatives Market: It is the market where financial instruments are traded whose value depends on the value of another underlying asset, such as options and futures.

- Foreign Exchange Market: It is the market where foreign currencies are traded.

- Commodity Market: It is the market where raw materials such as oil, gold and other metals are traded.

Foreign exchange market

The foreign exchange market, also known as the foreign exchange market, is a global, decentralized market in which currencies are traded. This market is unique due to its trading volume, extreme liquidity, large number and variety of participants, geographic dispersion, and the fact that it operates 24 hours a day, except weekends. Unlike stock exchanges, the foreign exchange market lacks a centralized location and operates as a global electronic network of banks, financial institutions and individual traders, all dedicated to buying or selling currencies by virtue of their volatile exchange rate.

Debt market

The debt market is a segment of the financial market in which debt instruments, such as bonds, notes, and treasury bills, are traded. These instruments represent the issuance of debt by government entities, companies or institutions in search of financing. Some features and functions of the debt market include:

- Risk: Involves a certain level of risk because the value of bonds may be subject to fluctuations based on multiple factors, such as interest rates, the financial condition of the issuers, and economic conditions.

- Regulation: It is subject to the regulation and supervision of the relevant authorities, with the objective of guaranteeing transparency, stability and investor protection.

- Variety: There are different types of debt instruments, such as corporate bonds, government bonds and promissory notes, each with particular characteristics in terms of terms, interest rates, credit risk and payment conditions.

Professional risk managers international association

The international capital market presents several associated risks, some of which are mentioned below:

- Exchange Rate Risk: Exchange rate risk refers to the possibility that fluctuations in currency exchange rates affect the value of investments in the international capital market.

- Market Risk: Market risk refers to the possibility that changes in market conditions, such as interest rates, asset prices, and market volatility, will affect the value of investments.

- Credit Risk: Credit risk refers to the possibility that issuers of debt instruments will not be able to meet their payment obligations.

- Liquidity Risk: Liquidity risk refers to the possibility that investors will not be able to sell their investments in the international capital market when they wish due to a lack of buyers.

- Political Risk: Political risk refers to the possibility that changes in government policies, wars, conflicts and other political events will affect the value of investments.

Is important to keep in mind that these risks can affect both individual investors and companies and governments that participate in the international capital market

Morgan stanley capital international world index

The Morgan Stanley Capital International Emerging Markets Index includes several funds and investment strategies. Some of the funds associated with the emerging capital market are the «NextGen Emerging Markets Fund» and the «Sustainable Emerging Markets Equity Fund» The NextGen Emerging Markets Fund focuses on overlooked areas of frontier and small emerging markets, with the goal of identifying the next generation of companies in these markets. In addition, the MSCI Emerging Markets Europe, Middle East and Africa Net Index is a market capitalization-weighted index adjusted for shares in free circulation that aims to measure the performance of stock markets in emerging market countries in Europe, the Middle East and Africa.

International capital market association green bond principles

Green Bonds are financial instruments that are issued to finance projects that have a positive impact on the environment and sustainability. The International Capital Market Association (ICMA) has established the Green Bond Principles to provide a framework for the issuance of these bonds. The ICMA Green Bond Principles establish four key components for the issuance of Green Bonds:

- Use of funds: Green Bonds must be issued to finance projects that have a positive impact on the environment and sustainability, such as renewable energy projects, clean transportation, energy efficiency and waste management.

- Evaluation process: Green Bond issuers must provide clear and transparent information on the intended use of the funds and how the environmental impact of the project will be evaluated.

- Fund management: Green Bond issuers must establish a clear process for fund management and supervision of the finance project.

- Reporting and verification: Green Bond issuers must provide regular and transparent reports on the use of funds and the environmental impact of the financed project, and must undergo independent verification.

Conclusion International capital market

The article provides an in-depth exploration of the International Capital Market, elucidating the diverse range of actors, financial market types, and associated risks. From governments and corporations to investors, banks, and financial institutions, each participant plays a pivotal role in the issuance, buying, and selling of securities within this global marketplace.

finance and economics